Still resilient, but profitability is under threat

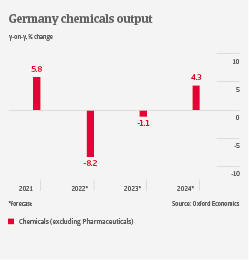

Production volumes in the German chemicals industry are currently shrinking, but due to higher sales prices, sales volumes are still slightly growing. With sharply increased energy and raw material prices, 10% of companies have recorded strong production declines, while 40% report sales growth. Energy and commodity prices have increased between 35%-50% for producers, which, in most cases, they can only partly pass on to end-customers. Consequently, about 70% of chemical businesses report decreasing profits.

Large fiscal support should provide some relief for chemicals and other energy-intensive industries. The German parliament recently passed an energy-relief package worth EUR 200 billion to support businesses and households alike, and the government plans to introduce price caps on electricity and gas early next year. However, stubbornly high inflation, higher interest rates and lower economic growth will negatively affect demand for chemicals in the coming months.

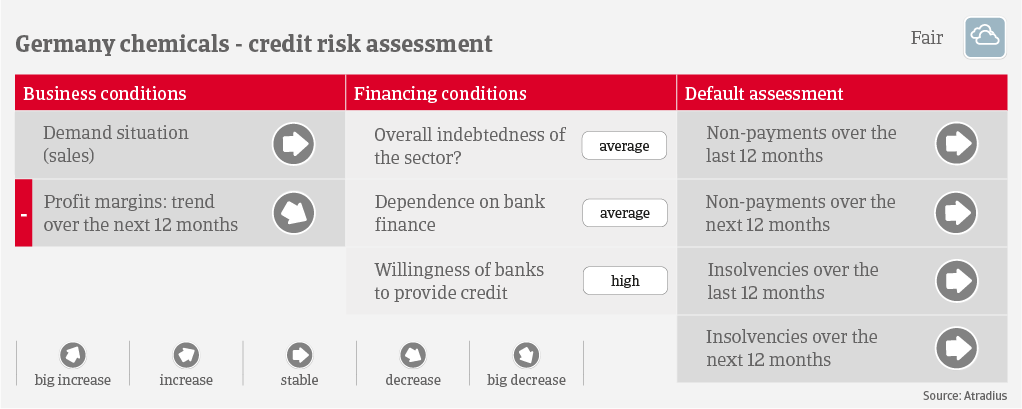

Generally, German chemicals businesses have robust equity, solvency and liquidity, which provides resilience in the current situation. A strong capitalization across the sector facilitates access to external financing, with an acceptable indebtedness structure and a well-balanced debt maturity profile. However, rising interest rates will increase financing costs for necessary investments (production facilities, tighter environmental requirements), which could lead to lower profitability.

Payments in the chemicals industry take about 30-60 days on average, and payment behavior has been very good during the past two years. Currently we expect no substantial increase in payment delays and insolvencies in 2023. However, despite strong fiscal support, there is still the downside risk of persisting high gas prices next year and/or a shortage of gas, which could trigger higher default rates and insolvencies.

We currently assess the credit risk situation of the chemicals sector as “Fair”, due to its financial resilience and still low default rate. Along subsectors, we see higher risks for the agrochemicals segment, which in the past received most raw materials from Ukraine and Russia, while high prices will curb sales. The soaps and detergent segment are extraordinarily affected by high raw material prices and face lower household consumption due to high inflation.

Downloads

2.03MB PDF