Rising insolvencies in the meat and food services segments expected

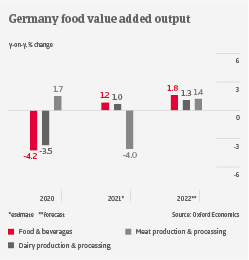

German food & beverages output is forecast to grow by about 2% in 2022, after increasing 1.2% in 2021, and a 4.2% contraction in 2020. Retailers have benefitted from higher consumer spending for premium food products, while food services businesses suffered from low hospitality and catering demand during the lockdowns.

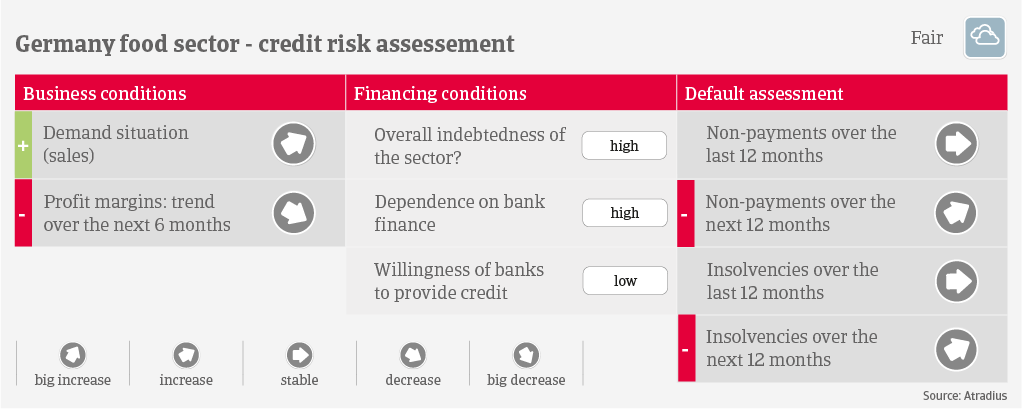

Currently the structurally low margins of food producers and processors are under additional pressure, as costs for commodities, energy, packaging and transport have increased. Passing on higher input prices is difficult due to the overwhelming market power of large retailers and discounters. The outlook for food services remains muted, as the ongoing spread of the pandemic hampers a comprehensive rebound of hospitality and catering.

The beverage segment has been struggling for years, affected by changing consumer habits (e.g. lower alcohol consumption). Additionally, lockdowns negatively affected demand. After a 6.9% contraction in 2020, beverages output declined again in 2021, by 1.3%. Despite pent-up demand, another 0.5% contraction is forecast this year. Meat output contracted 4% last year, with only a 1.4% rebound forecast in 2022. Producers and processors are facing major challenges: structurally thin margins, coupled with high input costs and changing consumer preferences (lower meat consumption and increased animal welfare awareness).

Banks remain rather unwilling to provide loans to the industry, which has increased the importance of factoring as a financing tool. Payments in the sector take about 45 days on average, and we expect that the number of payment delays and insolvencies will each increase by about 10% in 2022, as pressure on margins continues and government support gradually expires. Mainly affected will be businesses in beverages, meat and food service subsectors. Smaller players with poor financial strength are most at risk to fail, in particular if they lack export opportunities and/or do not offer specific products.

Our underwriting stance remains open for food retail, while being neutral for dairy, and fruits and vegetables. We are restrictive for beverages, meat and food services, as we expect the difficult business environment in those subsectors to persist in 2022 and beyond.

Downloads

915.0KB PDF