Lockdowns and a slowdown in the property sector affect demand

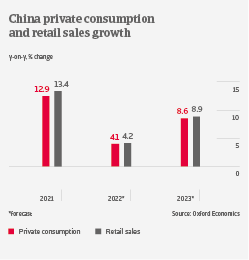

Sales of consumer durable goods increased by 12.5% in 2021, to CNY44 billion. In line with a slowdown of the economy and lower private consumption in 2022, we expect retail sales to slow, but still growing by about 4% this year. Higher global prices for commodities and energy have not yet affected the sector, but could have an impact as of H2 of 2022.

Online retail sales increased by 11% in 2020 and by 14% in 2021. Brick-and mortar retailers of home appliances and consumer electronics are the most affected businesses by online competition. Some of them have set up their-own online platforms, while others have adopted a strategy of product differentiation. Market shares of brick-and-mortar retailers continue to decrease.

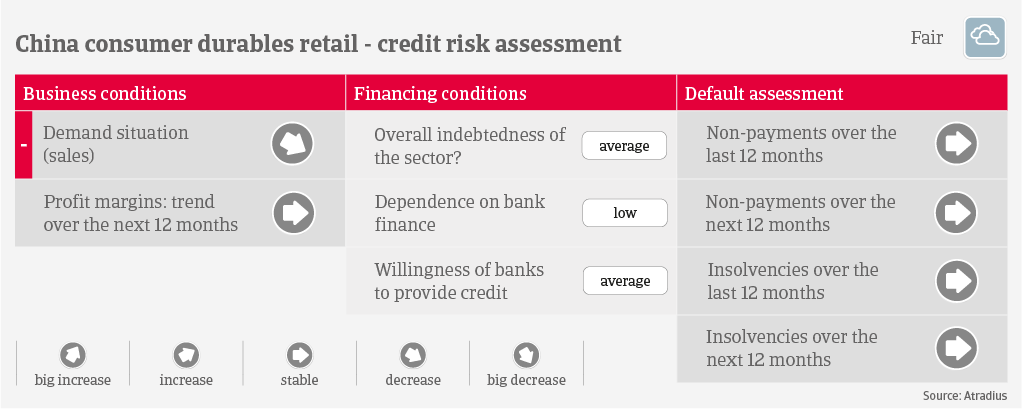

Currently several lockdowns imposed on larger cities due to the zero-Covid policy have a negative impact on revenues and profits of local consumer durables retailers. Another issue is the slowdown in the property sector, after the government has imposed stringent regulations to rein in real estate investment in order to cool down the market. This negatively affects demand for home appliances and furniture. We expect domestic appliances value added to grow by just 0.2% in 2022 after a sharp 12% increase last year. The consumer electronics should face lower demand this year, due to higher sales prices. However, retailers´ margins should remain stable, after recording increases in 2021.

Payments in the sector take 30-90 days on average. Payment terms of up to 90 days affect import-dependent retailers, due to currently slow sea shipments. Payment behaviour has been good over the past two years, and we expect no increase in payment delays or insolvencies in the coming 12 months. This is mainly due to fiscal support, as the government assists retailers with rent and tax rebates as well as subsidies.

Our underwriting stance is currently more restrictive for retailers located in cities and regions that are under lockdown for two months or longer. Apart from that, it is neutral across all subsectors. Most vulnerable to downside risks (more lockdowns, property sector woes) are small brick-and-mortar retailers. Those usually show weaker balance sheets and have limited bargaining power. We are more open to retailers that are state-owned, or have a strong group background.