Should the Sino-US trade dispute continue or even escalate, US petrochemical businesses would face unfriendly market conditions with falling prices.

- The Sino-US trade dispute has started to impact the industry

- Businesses continue to enjoy the cost advantage of shale gas

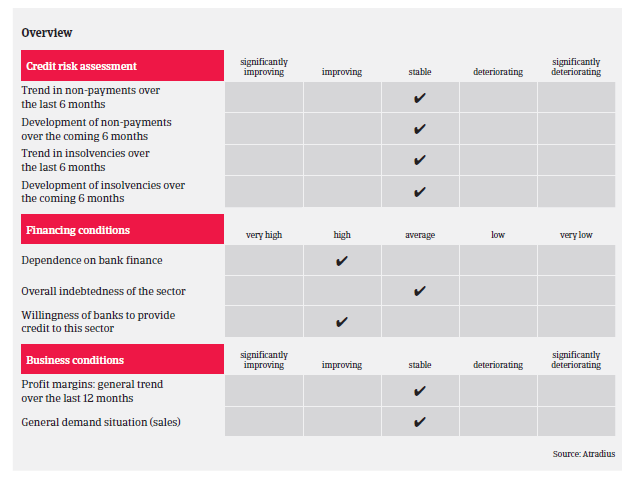

- Payments normally take between 30 and 90 days.

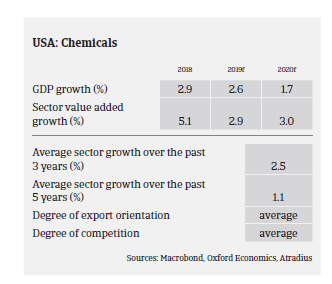

The US chemicals industry has continued to perform well in 2018, benefiting from cheap and abundant energy and feedstock supplies. The recent corporate tax reform has led to an influx of repatriated cash, used to repay company debt, fuel new business development activities or reinvest in US-based projects. According to the American Chemistry Council, total chemical production volume (excluding pharmaceuticals) increased 3.1% in 2018 and is expected to grow 3.6% in 2019, before easing to 3.1% in 2020 and 2.2% in 2021.

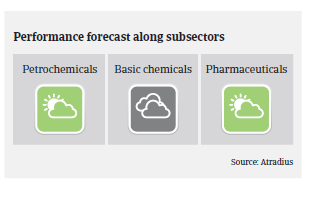

Basic chemicals production is expected to increase 4.8% in 2019 and 4.3% in 2020. In the specialty chemicals segment, production is forecast to increase 2.2% in 2019 following 3.7% growth in 2018. Gains in this segment were driven by growth in oilfield chemicals, electronic chemicals, coatings, adhesives, cosmetic chemicals, flavours and fragrances. In the coming years, demand is expected to grow in line with US industrial and construction sector expansion.

The US chemicals industry is expected to record a USD 38 billion trade surplus in 2019 as exports rise 10% (to USD 143 billion) while imports increase 7.8% (to USD 105 billion). Assuming there are no major trade disruptions, a USD 69 billion surplus in chemicals trade is expected by 2023. Access to export markets will be critical, since export growth will drive industry gains over the next decade (expanding global demand would be met by shale-advantaged chemicals sourced from the US).

However, there is the downside risk that the current trade disputes escalate further, with retaliatory measures by trade partners hitting the US chemicals industry with its substantial trade surplus. At the same time, additional US tariffs on chemicals-related imports would mean that US chemicals businesses pay more for feedstocks, negatively impacting their supply chains.

In the ongoing Sino-US trade dispute tariffs have already been imposed on many chemical and plastics products (petrochemicals, lastics, fertilizers, inorganic/organic chemicals). The US chemicals sector is already affected by the higher cost of materials imported from China, as well as by Chinese retaliatory tariffs on US exports. In 2018 US chemical exports to China rose only 2.7% after double-digit increases in 2016 and 2017.

In the petrochemical segment companies have made major investments in building petrochemical plants, in order to take advantage of cheap supplies of natural gas and access to international markets via the Houston Ship Channel. Many of those major investment decisions were based on the expectation that Chinese demand for US chemicals would furrther increase.

Should the trade dispute continue, and Chinese demand not materialise, petrochemical businesses could face an unfriendly market with rising global supply and falling prices. While US chemical companies are still making profits due to the low cost of natural gas, a persisting trade war with China would challenge them to sell to a more fragmented and competitive global market and to find new buyers (e.g. Latin America and Europe) in order to offset the lack of Chinese demand.

The US pharmaceuticals sector is expected to record value added growth of 2.4% in 2019 and 2.2% in 2020. Plans by the US administration to lower the price of prescription drugs have not yet materialised. The aging “baby boomer” generation and a subsequent surge in demand for pharmaceutical/health care products should sustain continued production and sales growth.

Profit margins of US chemicals and pharmaceuticals businesses are generally stable and the amount of protracted payments is low. Normally, payments in the industry take between 30 and 90 days. The number of insolvencies is low compared to other sectors and is expected to remain so in 2019, consistent with improving demand for chemicals and pharmaceuticals. Our underwriting approach to the chemicals and pharmaceuticals sector remains generally positive to neutral for the time being.

As the sector is highly fragmented and dependent on the broader economy and input costs, we scrutinise single subsector trends and end-markets. We also closely monitor US chemicals companies that do business in countries where the local currency has significantly devalued against the USD.

We are more restrictive when underwriting the fertilizer segment, which is negatively affected by a more challenging market environment for agriculture (commodity crop price weakness, adverse weather conditions and ongoing trade disputes).

Downloads

826KB PDF