Concerns about liquidity strain have increased

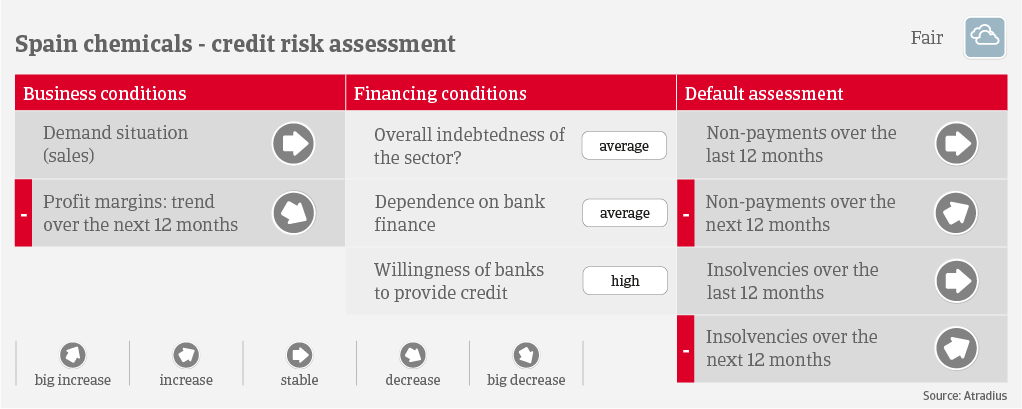

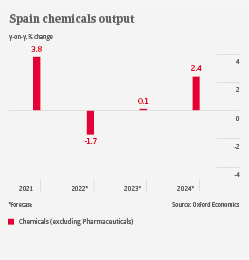

Demand from key buyer industries like automotive and construction has been stable so far in 2022. However, with persistently high inflation and a subdued 0.8% economic growth expectation in 2023, sales will most probably deteriorate in the coming months. After decreasing profits in Q2 of 2022 due to high energy (gas) and commodity costs, chemical producers have started to pass on price increases to end-customers since Q3. This resulted in a partial recovery of margins. Additionally, the Spanish government supports chemicals and other industries affected by high energy prices with state-guaranteed loans and a gas price cap.

Leverage of Spanish chemical businesses is generally not high, due to the sector being a good cash and EBITDA generator. Banks are mostly willing to provide loans, with bank finance usually required for acquisitions, important investments (in plants and equipment, for example) or working capital needs.

According to the latest Atradius Payment Practices Barometer, payment terms average 67 days from invoicing in the Spanish chemical industry, while Days Sales Outstanding (DSO) average more than 100 days. There is concern among businesses about deteriorating DSO in the coming months and a subsequent strain on liquidity. After low levels seen during the past twelve months, we expect both payment delays and insolvencies to increase in 2023, as demand shrinks and input costs remain elevated. However, we do not expect a severe deterioration of the sector´s performance.

We currently assess the credit risk situation of the Spanish chemicals sector as “Fair” across all segments. However, downside risks remain, as higher financing costs and deteriorating payment behavior increase the financial pressure on businesses, while at the same time demand from key buyer industries is about to decrease. At the same time, Spanish chemical companies could benefit from lower competition next year. This would be the case if their peers in central Europe are forced to cut production due to further rising gas prices or even gas rationing.

Downloads

2.03MB PDF