Slowdown in demand, and higher input prices

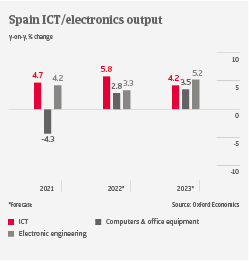

We expect ICT demand in Spain to remain solid in 2022 and in 2023. However, a slowdown of growth is underway due to lower purchasing power of businesses, while high food and energy prices have a negative impact on household purchasing power. At the same time, ICT producers and retailers alike are affected by high commodity prices, supply chain issues (semiconductor shortages) and geopolitical downside risks (war in the Ukraine).

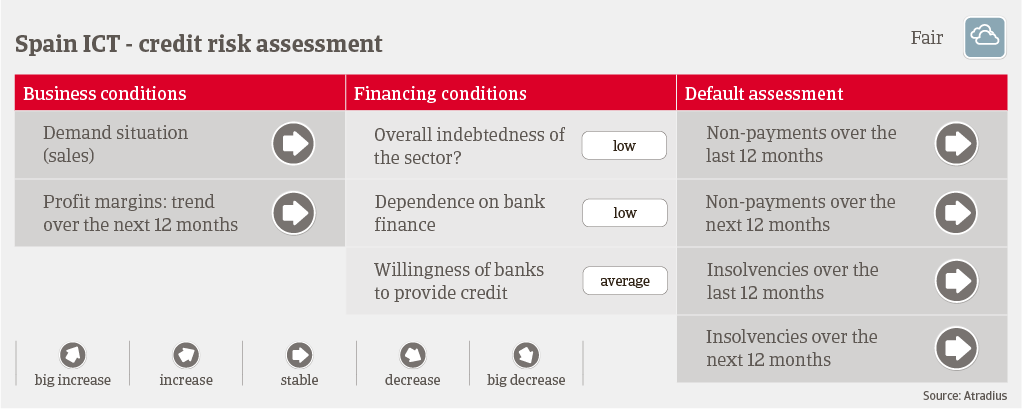

The Spanish IT market is highly competitive, and consists mainly of wholesalers and retailers, most of them operating with thin margins. Spanish IT businesses are mainly financed through suppliers, and secondarily through bank working capital lines. Overall indebtedness in the sector is low, and many businesses have benefited from fiscal support during the pandemic. In the telecommunication segment, companies are more highly leveraged compared to their peers in other subsectors, but they also record solid margins due to a favourable demand situation.

Major producers are not present locally, and electronic components are mainly imported from Asia, with Spanish importers currently facing high shipping costs. In the consumer electronics segment, large and financially strong international companies are active in Spain. Wholesalers and retailers can pass on higher input costs to end-customers, thereby preserving their profit margins.

Payments in the Spanish ICT industry take 60 days on average. Payment behavior has been good during the past two years, and the number of payment delays and insolvencies has been low in 2021 and H1 of 2022. In Q1 of 2022, ICT accounted for only 0.2% of business failures in Spain. Due to ongoing revenues, stable profit margins and moderate gearing of most businesses, we do not expect a substantial increase in ICT insolvencies in the coming twelve months. Based on the stable business performance and credit risk situation, our underwriting stance for ICT is open to neutral for all segments.

Downloads

986KB PDF